|

Bookkeeping Buddy: Why DIY Bookkeeping Doesn't Mean Doing It Alone Many small business owners attempt DIY bookkeeping to save costs and maintain control. Yet, this path can be daunting. Learn how you can manage your finances more effectively with my Bookkeeping Buddy subscription, ensuring you are never alone ... Building A Bookkeeping Business: Increasing Your Prices You may have already done the difficult part of starting your own bookkeeping business; you've found clients ... Coming Soon: smart document capture in Xero for faster bookkeeping Smart document capture in Xero streamlines record-keeping by uploading, emailing, or snapping a photo, prefilling data and matching to the bank ... Building Your Bookkeeping Business in 2026 Start your bookkeeping business with confidence! Learn how to find customers and gain experience in this helpful guide ... The real costs of starting a bookkeeping business: Part 2 Discover the real costs of starting a bookkeeping business, including overlooked expenses like policies and branding. Plan wisely and succeed ... The real costs of starting a bookkeeping business: Part 1 The real costs of starting a bookkeeping business revealed! Discover the non-negotiable expenses and create a clear budget ... Sage version 33 released: smarter, smoother, and future-ready Sage version 33 release focuses on reducing admin and improving compliance with cleaner email management and better VAT handling ... Making Tax Digital for the self-employed: thresholds, quarterly updates, and ways to stay calm Making Tax Digital for the self-employed is coming, with quarterly updates, new thresholds, and practical ways to keep costs under control ... Do you need to submit a self-assessment tax return by the end of January 2026? Find out when a self-assessment tax return is due by 31 January ... Why Should You Use A Bookkeeper? Wouldn't a bookkeeper make your life a whole lot easier? Having a clear picture of your finances at any given time is a must ... Some Great Reviews For My Bookkeeping Buddy Subscription Do It Yourself bookkeeping often feels like a chore when you're managing your own business accounts or even just starting off as a bookkeeper. This is why I created by Bookkeeping Buddy subscription and I'm getting some great reviews ... Sage 50 Accounts and Payroll subscription changes Sage 50 Accounts and Payroll subscription changes explained, with dates, pricing, and how to delay increases ... Why side hustlers should try the Etsy app for Xero today Easily manage sales, fees, and taxes with the Etsy app for Xero. Automate your bookkeeping and avoid errors. Try it now ... Autumn Budget 2025: What Every Bookkeeper Needs to Know Autumn Budget 2025 for bookkeepers brings changes to be aware of. Stay informed on updates and implications for your business ... AI bank reconciliation in Xero: will it transform your monthly close? Streamline month-end with AI bank reconciliation in Xero. Fast automation with human review ensures accurate matching ... Being a Bookkeeping Buddy Means Being Part Of A Community Join the Bookkeeping Buddy community for expert support and networking opportunities. Meet other bookkeepers and grow your business today ... How Small Creators Can Earn Money From TikTok I have been experimenting with TikTok to see how it all works so I am able to help and advise those with side hustles ... Be Careful Who You Call For IT Support If you have a problem with your computer and need help, be really careful who you call for IT support ... Download an Anti-Money Laundering package that actually helps! Download my Anti-Money Laundering package for simple templates, checklists, and tips that keep you compliant without the faff ... Get Ahead With The New Xero Certification Discover the new Xero certification: a flexible, faster path to prove skills and stand out ... Sage 50 Login Issues Explained: Why Users Must Now Enter An Email Here's the lowdown on Sage 50 login issues and the new email sign-in. Users now need a Sage ID for added security - even without cloud features. This blog post provides a quick setup guide and instructions on how to assist other users with logging in ... Understanding National Insurance For Side Hustlers A clear guide to national insurance for side hustlers, covering Class 2 changes, credits, and when to pay voluntarily ... How Payhip Helped Me Bring Bookkeeping Buddies To Life 'How Payhip Helped Me set up my Bookkeeping Buddies Subscription - a friendly space for business owners & bookkeepers to learn & connect.',

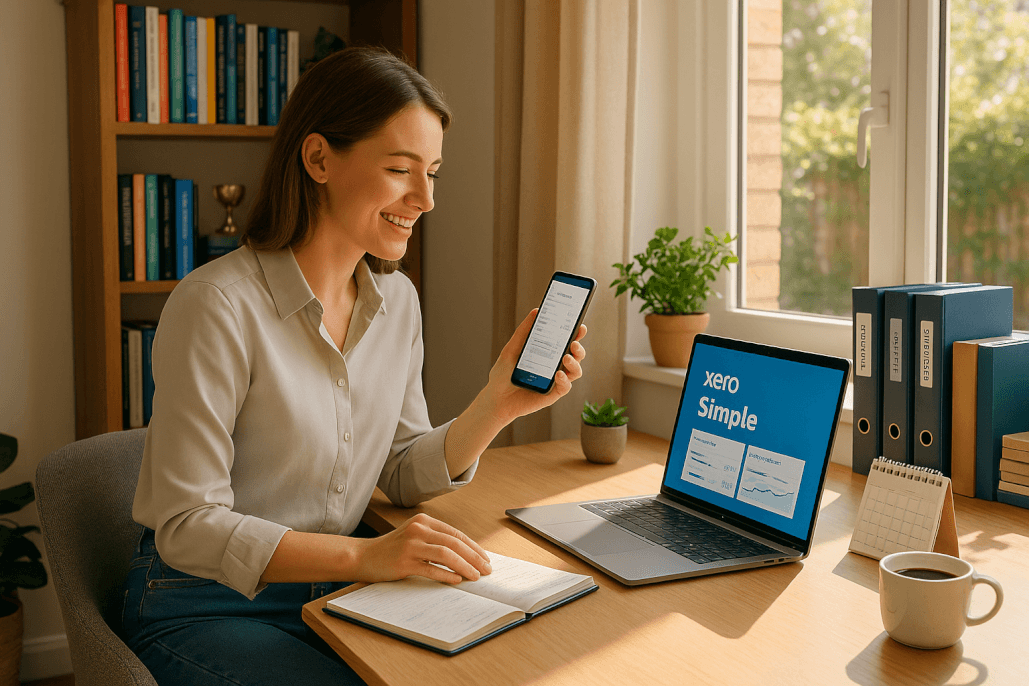

HMRC Triples The Side Hustle Tax Return Threshold The side hustle tax return threshold is set to triple, changing how many report small earnings ... Exciting Changes Are Coming To Xero: Now You Can Navigate With Ease! Big changes are coming to Xero! A revamped navigation system and homepage will enhance your bookkeeping experience and provide valuable insights . Prepare for Xero Price Rises: Essential Updates and Insights for Your Business The upcoming Xero price rises in September 2025 bring essential updates for users. Understanding these changes ensures businesses are ready ... Unveiling Sage 50 Accounts Version 32: A Comprehensive Overview of New Features Sage 50 Accounts Version 32 has arrived, bringing exciting improvements, including AI-driven reporting, enhanced document management, and banking compliance features ... Xero Now Offers More Ways to Get Paid With Stripe & GoCardless Xero offers more ways to get paid with Stripe and GoCardless integration. Improve cash flow and client satisfaction with innovative payment solutions How Sage Business Cloud Calculates Flat Rate VAT Flat Rate VAT Scheme? Learn how Sage Business Cloud calculates your VAT return and stays compliant ... Microsoft Withdraws Free Licenses for Charities And Non-Profits Microsoft to withdraw free licenses for charities by July 2025. Impact on non-profits and their missions. Learn more ... Xero Cashbook Subscriptions to become Xero Simple If you’re a Xero user, you might have already heard the news that Xero Cashbook is out, and Xero Simple has arrived. But don’t worry, this isn’t one of those “new name, same headaches” kind of changes. In fact, it’s quite the opposite ... How a Cyber Attack Compromised a Bookkeeper's Security When a cyber attack struck a bookkeeper friend of mine, it revealed the hidden dangers of downloading files from seemingly trustworthy sources ... |

| The Blog of Silicon Bullet By Alison Mead, Bookkeeping Mentor ... |