Claiming VAT On Mileage | You can, but only some of it ... |

POSTED BY ALISON MEAD ON 24/02/2020 @ 9:00AM #IT #Xero #Sage #Training #UK If you're driving your own car and thinking of claiming VAT on mileage and your company is VAT registered, then remember you can, but only some of it ... If you're thinking of claiming VAT on mileage? You can, but only some of it! copyright: hfng / 123rf The way it works is you can claim mileage rates of 45p per mile for the first 10,000 miles done in the year, then 25p per mile from then on. This mileage rate, however, is meant to cover you for fuel, wear and tear and road tax.

"Basically, you're claiming all the costs related to driving

your car for your business miles!"

HMRC allow you to claim back the VAT part of the fuel element only. This fuel element varies depending on what sort of car you drive. Advisory fuel rates change regularly so you should always look them up on the HMRC website.

As an example, if you drive a petrol vehicle with an engine size over 2000cc then you can claim the VAT element on 21p per mile, 1401cc to 2000cc is 14p per mile and less than 1400cc is 12p per mile. These were the rates as of 1st December 2019 but are subject to change.

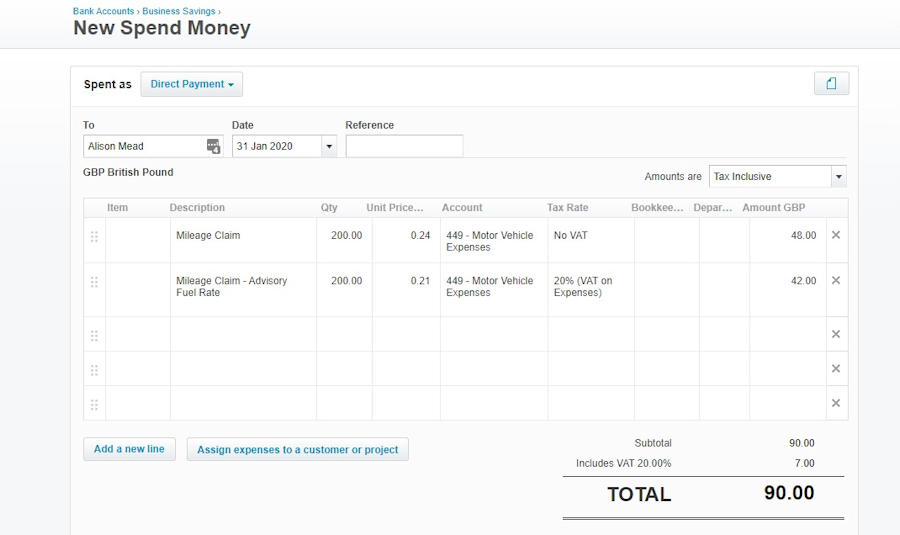

So here is a worked example for you.

If you drove 200 miles for your business in January 2020 in a petrol vehicle and your engine size is greater than 2000cc, I would work out the fuel element like this:

Mileage claimed total is 200 x 45p = £90.00 Fuel element is 200 x 21p then divided by 6 for the VAT = (200*21) /6 = £7.00 Therefore entering into the accounts that would be a total of £90.00 which is a net amount of £83 with a VAT total of £7.00

Does that make sense?

In Sage, you can enter it in one line as a bank payment or supplier invoice if that is how you claim expenses and just enter the NET and VAT columns to be £83.00 and £7.00 respectively, using Tax Code T1.

As you can see from the image above, in Xero you will need to split your transaction into two lines; the VAT element on one line with the rest on the next line, as per this example. Until next time ...

ALISON MEAD

I'm your Bookkeeping Buddy: Discover more by clicking here!

Would you like to know more? If anything I've written in this blog post resonates with you and you'd like to discover more, it may be a great idea to give me a call on 01604 420057 and let's see how I can help you. About Alison Mead ... |  | | Alison loves bookkeeping and supporting bookkeepers. She has been helping clients to be better bookkeepers in Sage 50 for over 24 years and has been Xero Accredited in accounts and payroll for a number of years too.

She specialises in a very unique hand-holding method of training, helping bookkeepers and business owners to use their accounts software as and when they need support in setting up and producing their invoices, reports and financial information.

Alison combines her role at Silicon Bullet with her Forever Living network marketing businesses and is often to be seen at business networking meetings as she likes to keep busy.

You know what they say: if you want something done well ask a busy person!

|

|

More blog posts for you to enjoy ... | | | | | | | | |

|