How To Correctly Post Your Salary Journal | This applies to all payroll software ... |

POSTED BY ALISON MEAD ON 27/07/2020 @ 9:00AM #IT #Xero #Sage #Training #UK When doing bookkeeping training, one of the most common errors I come across is the incorrect posting of the salary journals. You need to accurately reflect the cost of your wages in your accounts ... With the right bookkeeping training, posting your salary journal is straightforward! copyright: silicon bullet This normally includes the gross salary for your staff plus the employer's National Insurance, and increasingly, especially with auto-enrolment, the cost of your employer's pension too.

The common mistake is to allocate payments paid to staff and your HMRC payment straight into the wages costs area of your profit and loss account. In Sage50c that would be to codes in the 7000 range, and in Xero it would be a direct cost or overhead in the 300s or 400s.

"This will get you by, but wouldn't you rather learn how to post the journals properly?"

To correctly post your salary journal, each journal needs to have a matching debit and credit in any double-entry bookkeeping system. The salary journal is no exception.

Usually, the wages are run a few days before they are actually paid, and the Income Tax and National Insurance are not due to be paid until the 19th of the following month. This means the costs of the wages should be posted to the profit and loss account, then the planned net wages and any tax or pension payments should go into the balance sheet until they are paid.

If you have any student loans to collect and pay to HMRC then I would add this to the PAYE total in the journal, as the figure is added to the PAYE in the P32 form which tells you what to pay HMRC and is included in the payment to them.

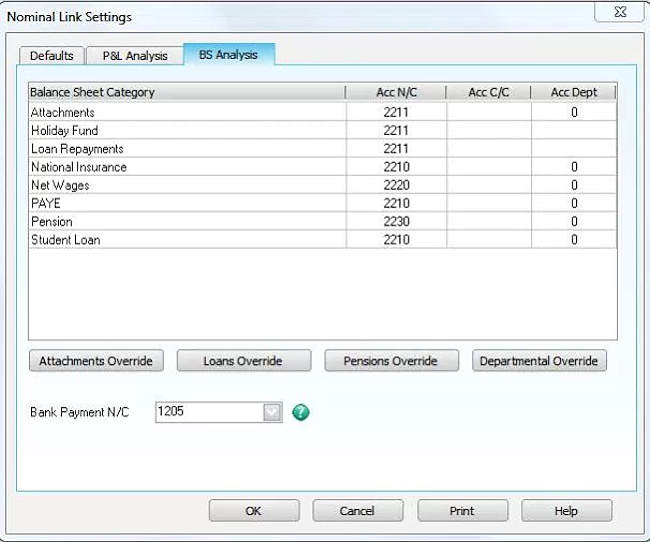

"Here's an example salary account codes in Sage!"

This is an example of the codes used in Sage 50 Payroll to post the Salary journal. There are codes in the balance sheet also for attachment of earnings if these are to be deducted from net pay. If you are a small employer eligible to reclaim any Sick Pay, Maternity Pay or Adoption Pay in the month this can be posted to the PAYE/NI account to reduce the payment being made to HMRC.

When you actually pay your staff and see the payments on the bank statement, you should record your wages and HMRC payments. This bank payment should then be entered using the same code as your Net Wages (2220 in Sage and Wages Payable 814 in Xero). This means that at the end of each month after the wages are paid, the account in the balance sheet should be zero. If it is not then there is something wrong in the accounts.

The payment of PAYE/NI to the HMRC should be posted to the PAYE/NI account (2210 in Sage and 825 PAYE Payable in Xero). When you first install Sage and Xero, there are usually separate PAYE and NI accounts, but these should be consolidated into one as HMRC like to have one payment with the totals combined, and you don't want to have to split your payment when made into two different accounts.

Payment made to the pension fund should be made to the balance sheet pension fund code (2230 in Sage and 858 Pensions Payable in Xero), which should be the total of the employees and employers contributions added together.

"You can automatically post your wages!"

If you use Sage50c, you can use the Nominal Link to automatically post your wages from Payroll into Sage50c. This can save a lot of time and effort and reduce the scope for human error, and if you use Xero the payroll journal is posted automatically for you when you use Xero to process your payroll.

The examples given in this blog post are in Sage 50 Payroll, but the same theory applies whatever software you use. Until next time ...

ALISON MEAD

I'm your Bookkeeping Buddy: Discover more by clicking here!

Would you like to know more? If anything I've written in this blog post resonates with you and you'd like to discover more, it may be a great idea to give me a call on 01604 420057 and let's see how I can help you. About Alison Mead ... |  | | Alison loves bookkeeping and supporting bookkeepers. She has been helping clients to be better bookkeepers in Sage 50 for over 24 years and has been Xero Accredited in accounts and payroll for a number of years too.

She specialises in a very unique hand-holding method of training, helping bookkeepers and business owners to use their accounts software as and when they need support in setting up and producing their invoices, reports and financial information.

Alison combines her role at Silicon Bullet with her Forever Living network marketing businesses and is often to be seen at business networking meetings as she likes to keep busy.

You know what they say: if you want something done well ask a busy person!

|

|

More blog posts for you to enjoy ... | | | | | | | | |

|