Auto Enrolment: Pension Rates Are Changing |

Are your staff included? |

POSTED BY ALISON MEAD ON 04/03/2019 @ 8:00AM

Under the Pensions Act 2008, the minimum amounts paid into Auto Enrolment pension schemes are increasing for employers and staff ...

Remember, the auto enrollment pension rates are changing in April!

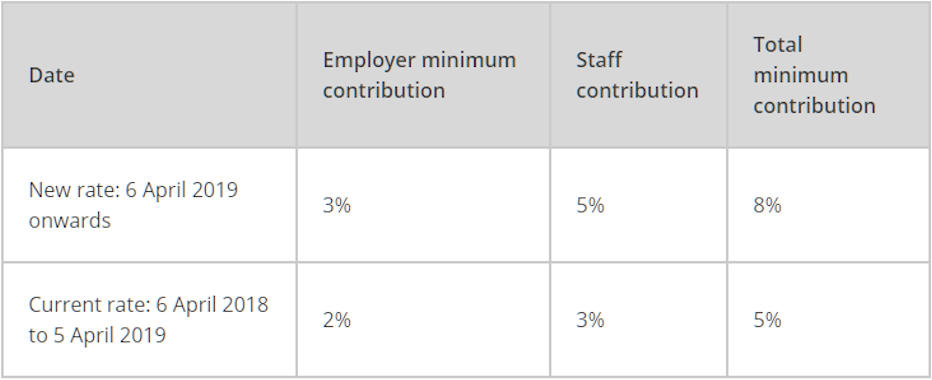

From April 2019, the amount of money people pay into workplace pensions will rise as minimum contributions from employees are increased from 3% to 5% under auto-enrolment rules. Employers will also see their contributions go up from 2% to 3%

Every time you pay your staff, or take on a new member of staff, you should be assessing them to see if they need to be put into a pension scheme for automatic enrolment.

By law, a total minimum amount of contributions must be paid into the scheme. You, the employer, must make at least the minimum employer contribution towards this amount and your staff member must make up the difference.

If you decide to cover the total minimum contribution required, your staff won't need to pay anything. As well as continuing to assess your staff each time you pay them, every three years you will need to re-enrol staff who have left your pension scheme and who meet certain criteria.

"Would you like to know more?"

If you'd like to find out more about Auto Enrollment, then do give me a call on 01604 420057 or click here to ping me an email and let's see how I can help you.

Until next time ...

ALISON MEAD

I'm your Bookkeeping Buddy: Discover more by clicking here!

Leave a comment ... |

More about Alison Mead ... | ||||||

|